Introduction:

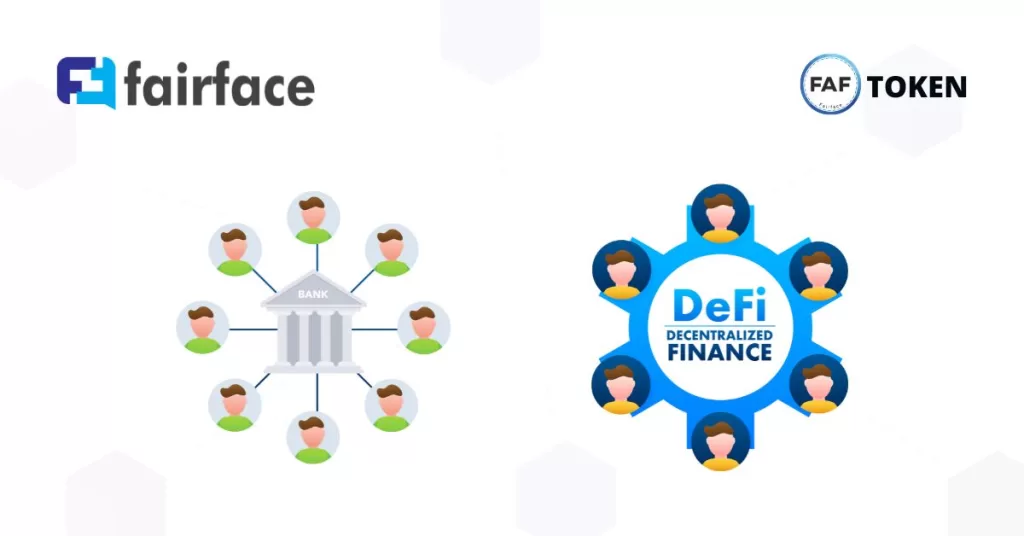

The financial landscape is undergoing a profound transformation, and investors are at the forefront of this revolution. In recent years, the emergence of DeFi (Decentralized Finance) has challenged traditional CeFi (Centralized Finance) systems, offering a paradigm shift in asset management. In this blog post, we will explore how investors can embrace DeFi to redefine their asset management approach and unlock new opportunities.

1. Embrace Financial Inclusivity:

One of the most compelling aspects of DeFi is its inclusivity. Anyone with an internet connection can participate in DeFi protocols, eliminating the need for intermediaries like banks. Investors can now access financial services, earn interest, and engage in lending and borrowing without geographical restrictions or account requirements.

2. Control and Ownership:

DeFi puts the power back into the hands of investors. With CeFi, you often surrender control of your assets to centralized institutions. In contrast, DeFi allows you to maintain ownership of your assets while participating in a wide range of financial activities. This enhanced control minimizes counterparty risk and ensures greater security.

3. Diversification and Yield Farming:

DeFi platforms offer an array of opportunities for investors to grow their portfolios. Yield farming, for example, allows you to stake assets in liquidity pools and earn rewards in the form of additional tokens or interest. Diversifying your investments across different DeFi projects can provide attractive yields and mitigate risk.

4. Decentralized Exchanges (DEXs):

DeFi has introduced decentralized exchanges (DEXs) that facilitate peer-to-peer trading without intermediaries. Investors can swap, trade, and invest in a wide range of tokens directly from their wallets. This not only enhances privacy but also eliminates costly exchange fees.

5. Transparency and Audibility:

Blockchain technology underpins DeFi, ensuring transparency and audibility. Every transaction and smart contract execution is recorded on a public ledger, allowing investors to verify the integrity of the ecosystem. This transparency reduces the risk of fraud and manipulation.

6. Risk Management:

While DeFi offers numerous opportunities, it’s essential to acknowledge the risks. Smart contract vulnerabilities and market volatility are factors to consider. However, with careful research and risk management strategies, investors can navigate these challenges effectively.

7. Education and Due Diligence:

As investors transition from CeFi to DeFi, it’s crucial to invest time in learning and due diligence. Understanding the DeFi projects you engage with, their teams, and their smart contract audits is vital to making informed investment decisions.

Conclusion:

The shift from CeFi to DeFi is not just a change in investment strategy; it’s a transformation of the financial ecosystem itself. Investors can redefine their asset management approach by embracing the inclusivity, control, and diverse opportunities that DeFi offers. However, it’s crucial to approach this space with caution, educate oneself, and manage risk effectively. By doing so, investors can participate in the exciting world of DeFi and potentially reshape their financial futures.